The 3 Hour Crypto Setup

We are two computer scientists (A & B) who have been using cryptocurrencies for about 5 years. We’ve written a practical introduction for getting started with cryptocurrency. We’ve distilled all of this into 3-hour guide you can finish over a workday night.

We’ve written this guide because friends and family have been talking about cryptocurrencies. There is currently so much bad advice out there now playing to people’s greed. We’ve tried to be objective and cautious.

We’re very pragmatic about what people want to learn. However, we’ve put in links and explanations that shed some light on the underlying philosophies and technologies behind cryptocurrencies. We hope that these will be the long-term takeaways from this guide.

Some Caveats

This guide is for non-technical beginners and defaults to the simplest way to get things done. This often comes through some trade-off (privacy, security, fees) which we will make a note of.

We do not make any money from this guide. The text and code is open source on Github. There are no affiliate links. If you think there are errors or improvements, please feel free to fork and issue a pull request.

What we’ll be doing

In 3 hours, you’re going to buy your first $10 of Bitcoin, $10 of Ethereum and $10 of an Altcoin. We’ll walk you through buying this on an exchange, and then transferring it to your own desktop/offline wallet. This is the basic setup for cryptocurrencies you’ll need to send and receive money in a cryptocurrency world.

What you need

- $30: This guide defaults to $10 of Bitcoin, $10 of Ethereum, and $10 of an Altcoin. Please read the Should I “Invest” section as to whether you should put in more.

- Debit/Credit Card: We use a debit or credit card to keep this guide within 3 hours. If you don’t have one, you can use a bank account or find a local seller but those will take 2-5 days.

What you’ll have after 3 hours

- Bitcoin/Ether Exchange: (e.g. Coinbase) You’ll be exchanging $30 here, $10 of Bitcoin and $20 of Ether. We’ll learn the major concepts behind these two cryptos, and how they are different.

- Desktop Wallet: This is where you’ll store and keep your cryptocurrency. We’ll learn about the We’ll touch on security and how to avoid losing your bitcoin.

- Altcoin Exchange: (e.g. Bittrex or Binance) You’ll be sending $10 of your Ether to this exchange, to buy $10 of an Altcoin. We’ll learn about the wild, wild west of tokens, and the ideas they represent.

- Understanding the big ideas: You’ll have a high-level understanding of the technologies behind distributed ledgers, blockchains, and smart contracts.

Should I “Invest”?

We cannot advise you on this. There’s been a lot of hype and doom around cryptocurrencies. The honest truth is that cryptocurrencies are just another societal experiment in the long arc of humanity. History is filled with examples of experiments like this. Some are wildly successful and redefine how the world works. Others pale away after the initial hype, fading into the ash heap of history.

There exists a future where Bitcoin is the world’s reserve currency, and a few dominant smart contract platforms (Ethereum, Stellar, Cardano etc) are utilized for everyday business interactions. Tokens power efficient decentralized networks that coordinate essential services.

There also exists a future where Bitcoin and privacy coins are legislated to the margins of society, and where smart contract platforms take decades to get to the valuations they saw during the bubble of 2017/2018. Many decentralized networks’ tokens faded into obscurity after failing to prove more efficient than centralized incumbents.

Invest your time instead. Beneath the bubble and hype are some real technological innovations. Learn about the ideas behind cryptocurrencies. Use it to pay for a good or service. Program a smart contract. Technology can only have value when it is used - so use it before forming an opinions on it as an “investment”!

1st Hour: Bitcoin & Ether

Bitcoin was the first major decentralized digital currency, and uses cryptography to maintain a distributed ledger of transactions. The Guardian has a good introduction:

As of Nov 2017, there are several variants of Bitcoin such as Bitcoin Cash and Bitcoin Gold. These are different from Bitcoin. One of the best summaries of this can be found on Reddit on this subject.

What is Bitcoin?

To use fiat currency (e.g. USD, JPY, etc) to buy cryptocurrency, you will need a fiat exchange. These exchanges will offer to exchange your fiat currency (e.g. USD) into cryptocurrency at a particular exchange rate. Most exchanges will also charge you an exchange fee (~3%) for making the exchange.

Setup Fiat Exchange (30min)

As of Dec 2017, there are many exchanges and you should research which one is best for your country for future transactions.

- US Residents: Coinbase is the de-facto beginner’s exchange. However it is only available in 33 countries, and verification sometimes takes a long time.

- Non-US Residents: Use BuyBitcoinsWorldwide to find an exchange in your country.

As of Dec 2017, many exchanges require verification which can take up to days or weeks. For those who just want to start ASAP, we recommend the following exchanges with minimal verification:

- Coinmama has no country restrictions and minimal verification checks, but has expensive exchange rate and high fees.

- Buysomebitcoins is similar.

The fastest way to buy cryptocurrencies is with a credit/debit card, which is what we’ll use in this guide. If you don’t have a credit card, there are the following options:

- Bank Transfers, which have lower fees but take 2-3 days (or more) to go through.

- LocalBitcoins where you trade with local bitcoin sellers in cash.

- Paxful is an interesting alternative where you can buy using alternative payment methods like Western Union, Paypal, or trading in Amazon Gift Cards.

Your first Bitcoin (15 min)

We’ve identified two good video tutorials. You can typically search on Youtube to find walkthroughs for whichever exchange you are using.

Option 1: Buying using Coinbase

Option 2: Buying using Coinmama

Extra: How does Bitcoin work?

Extra: How do Blockchains work?

Your first Ether (15 min)

Ether is (as of Nov 2017) the second biggest cryptocurrency. Ether is the token of the Ethereum network. It allows developers to build and deploy smart contracts on its blockchain. These can be used to create decentralized applications, which can have profound and powerful impacts on how we structure organizations. Here is a good high-level introduction.

Buying Ether with Coinbase

You’ll be buying $20 of Ethereum. You’ll subsequently be using $10 of Ethereum to buy an Altcoin.

Extra: The World Computer

Let’s use the next 25 minutes to really understand what you’ve just bought with your $25.

2nd Hour: Altcoin Land

“Altcoins” are commonly used to describe cryptocurrencies that aren’t Bitcoin or Ether. Better known Altcoins include Dash, Stellar and OmiseGo. This is the wild west of cryptocurrencies, where new coins are being listed every day.

Most Altcoins aren’t listed on the major fiat exchanges. In fact, most are listed on Altcoin exchanges like Bittrex, Binance, and decentralized exchanges like Etherdelta. These exchanges don’t accept credit cards or fiat currencies - they exchange Bitcoin/Ether for Altcoin at given BTC/ALT exchange rates.

For this guide, we’ll be exchanging $10 of the Ether that you bought earlier for $10 of an Altcoin. Some popular altcoins people buy using this guide include Ripple, IOTA, Dash and Monero.

Choosing an Exchange

Caution [Dec 2017]: We would caution you against using Bitfinex due to concerns about money withdrawal. We advise you to form your own opinion after researching this more online.

Given the explosion of Altcoins over the past few months, there is no one-stop shop for every Altcoin. Many of the 1382 coins have just been launched in the last few months, and are in the process of being added to exchanges. The more established Altcoins (e.g. Ripple, IOTA) trade on bigger exchanges like Binance and Bittrex, while newer coins trade on smaller or less established exchanges like Cryptopia. It’s a cowboy town in many of these new exchanges and caution and a healthy amount of googling is advised.

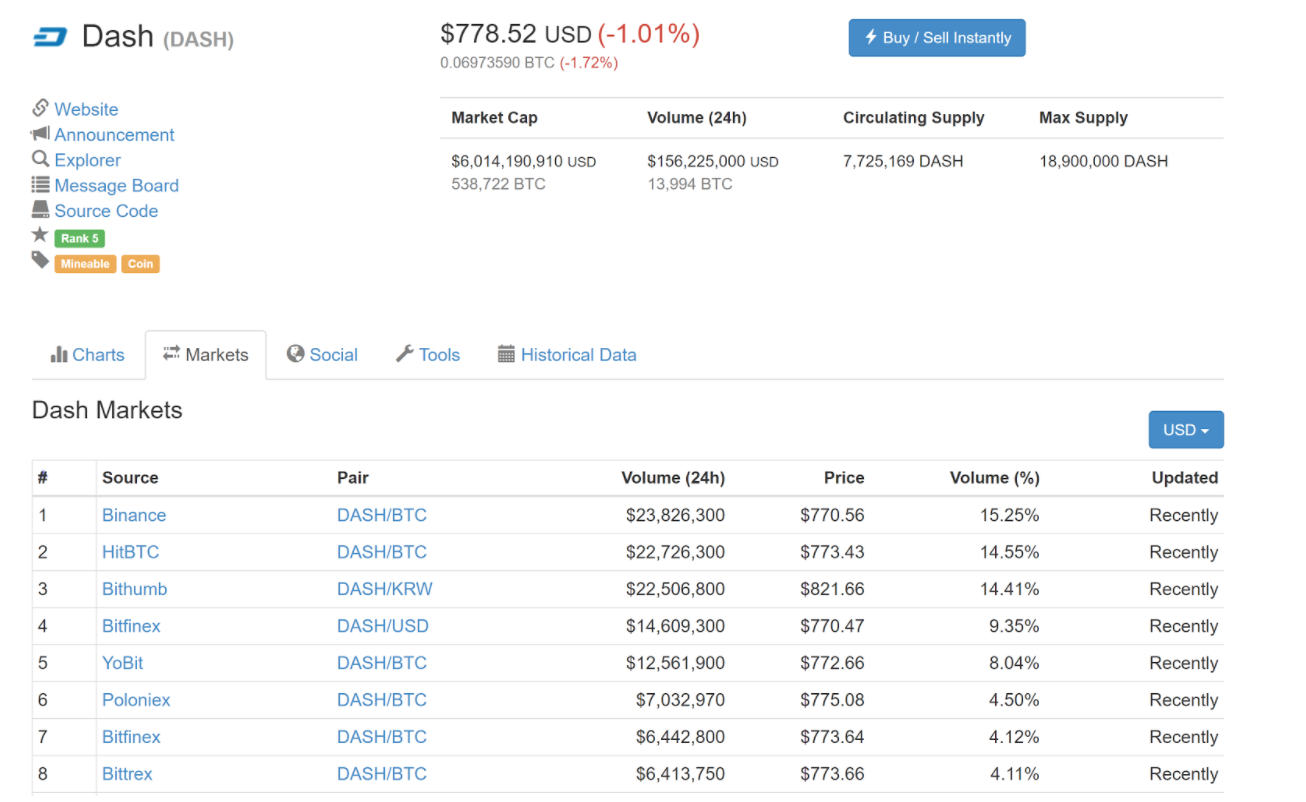

If you are interested in trading a specific Altcoin, you can use Coinmarketcap to find out which exchanges it trades on. By looking at the “Markets” tab of a particular cryptocurrency, you can see the exchanges on which it trades on.

List of exchanges that Dash trades on

List of exchanges that Dash trades on

Types of Altcoins

(In progress)

Option 2: Binance

In recent weeks, Binance has become a popular exchange with significant volume and coin availability. One of its innovations is its own coin (BNB) that gives you 50% off trading fees. It also allows you to start trading ASAP as it doesn’t require identity documents until you hit $30,000.

Registration and Depositing $10 of Ether

We’ll be transferring $10 of the Ether you got at Coinbase/Coinmama to Bittrex to buy some Altcoin.

Key Note: DO NOT TRANSFER YOUR $10 OF BITCOIN. As of Dec 2017 Bitcoin transaction fees have hit ~$30, even for a $0.1 transfer. It will likely stay that way for a few months as their developer community figures out scaling issues. Do not transfer your bitcoin because they will be wiped out by the fees!

Start by following these steps on Binance

- Go to the

Deposits & Withdrawalssection inFunds - Search for your “ETH” wallet in the wallet list. MAKE SURE IT IS THE ‘ETH’ WALLET as you don’t want to send your funds to the wrong address!

- Click on

Deposit. You will see your Binance ETH Wallet’s address, which you will be depositing funds to. Copy this address.

Then, go to Coinbase

- Go to

Accountsand select your ETH wallet. - Click

Send. Paste your Binance ETH Wallet’s address which you copied earlier into this field.ALWAYS make sure to double check that the wallet address that you copied and pasted is the same! Leaving out even 1 character would result in your funds being sent incorrectly and possibly lost forever.

Buying $10 of Altcoin on Binance

This video gives a good overview of how to use the Binance exchange.

Option 2: Bittrex

Registration and Depositing $10 of Ether

We’ll be transferring $10 of the Ether you got at Coinbase/Coinmama to Bittrex to buy some Altcoin.

Key Note: DO NOT TRANSFER YOUR $10 OF BITCOIN. As of Dec 2017 Bitcoin transaction fees have hit ~$30, and will likely stay that way for a few months as their developer community figures out scaling issues. Do not transfer your bitcoin because they will be wiped out by the fees!

You should follow Bittrex’s official guides at the links below. For those who prefer watching videos, we’ve found a few and embedded them below.

Note: It is not necessary to do the enhanced verification if you plan to leave the altcoin you buy on exchange. Bittrex only requires enhanced verification when you want to withdraw it.

Buying $10 of Altcoin on Bittrex

For this section, we will be using Dash as an example. You can replace this with any Altcoin that you like (e.g. Ripple, Monero etc).

- Go to the relevant Bittrex market page. For this example, this is the ETH/DASH page.

- The

Last Priceshows the last transacted price of one Dash per Ether. At the time of writing 1 Dash buys 1.668 Ether. - Go to the

Buy Dashtab. - Under

Bid, you will see a blue Dropdown button called Price. Click on it and choose the optionAsk.What you are doing here, in plain-speak, is offering to pay what the cheapest seller of Dash is offering in Ether terms. In finance-speak, you are crossing the spread.

- Click

Max. This will buy the maximum Dash you can with your deposited Ether! - Then click the blue button at the bottom of the box Buy Dash to execute.

Key Tip: Occasionally, your order will not go through, especially if Dash is increasing in price quite fast. Lower down on the screen, there will be an

OPEN ORDERStab. There will be a red X button all the way on the right. Click that red X button to cancel the order, and follow the process above again, to offer a higher Dash price so that sellers will be willing to sell.

3rd Hour: Desktop Wallet

If you’ve completed the previous steps, the $10 of Bitcoin, $10 of Ether and $10 of Dash you bought are sitting on what is known as an exchange wallet on Coinbase or Bittrex (or whatever exchange you used).

It tends to be very dangerous to leave your cryptocurrencies on an exchange. Exchanges are often prime targets for hackers (e.g. 120,000 Bitcoins being stolen from Bitfinex). Poorly-run exchanges have also gone down in the past, taking all of customers’ money with them (e.g. Mt. Gox’s collapse in 2014). Even a well-run exchange like Coinbase with extensive security measures is still susceptible to phishing and impersonation attacks.

Setting up Exodus (10min)

A wallet is like a mini-bank account which you are in full control of. We recommend most beginners start using a desktop or mobile wallet. Almost all cryptocurrencies have their own version of a desktop wallet. These wallets store your cryptocurrency’s private keys on your personal computer or mobile device. There is a small risk of loss from malware or crashes. For now, this should be sufficient for your basic cryptocurrency setup.

For this walkthrough, we’ll be guiding you to set up Exodus, a pretty, multi-currency desktop wallet that can store both Bitcoin, Ethereum and some Altcoins. As of Dec 2017, there are many other wallet options available.

Installing on Mac

Installing on Windows

Transferring Coins (30min)

Key Note: As of Dec 2017, Bitcoin transaction fees have hit ~$30, and will likely stay that way for a few months as their developer community figures out scaling issues. Do not transfer your bitcoin because they will be wiped out by the fees! You can use Coinbase’s Vault to safekeep your $10 of Bitcoin.

We’ll be transferring your coins from Coinbase and Bittrex to your Exodus wallet. We’ll start with the $10 in Ether that you still have on Coinbase.

Transferring from Coinbase

Or, if you’re reading sort, this tutorial from Canadiancrypto covers how to move Bitcoin from Coinbase to Exodus.

Transferring from Bittrex

Setup Backups (15min)

Please, please, please set up backups for your wallets. This is very important just in case something happens to your computer (loss, hacked, magnetized).

Extra: Security Tips

We’ve recommended desktop wallets to start you off. Once you start holding more than $5,000, we would recommend you to explore more secure options to hold your cryptocurrency:

-

Hardware Wallets store your cryptocurrency in a USB-stick like devices which are less exposed to malware. These typically cost money and we would recommend you get them once you hold more than ~$300 of cryptocurrency. We personally use the Ledger Nano S.

-

Paper Wallets are the safest way to keep your cryptocurrency but also the most complicated. We typically do not recommend this unless you have been working with cryptocurrencies for a while. You can find instructions for a Bitcoin paper wallet over here, and Ethereum’s paper wallet here.

Key Risks to Remember (5 min)

These are the important things to remember about your cryptocurrencies and your wallets.

- Desktop/Mobile wallets are vulnerable to your computer crashing/malware because the private keys are stored only on your computer.

- Hardware wallets are vulnerable to you losing your device, or hardware failure

- Paper wallets are vulnerable to you losing the piece of paper on which your private key is written. Remember, anyone who sees it can take your cryptocurrency!

Epilogue

Learn More

Vinay Gupta at Michel Bauwens & the Promise of the Blockchain from FIBER on Vimeo.

Decentralization

This is one of the best videos explaining the concepts behind the blockchain and cryptography.